ckramer

New in Town

- Messages

- 23

- Location

- Logroño, Spain

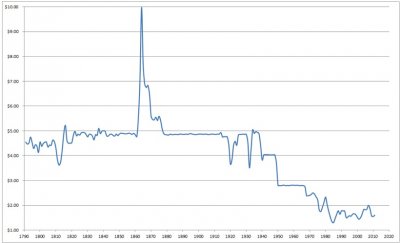

I really enjoy a good western, spaghetti or Hollywood, and because many of them deal with bounties and the like, money comes up (i.e. the price on someone's head). To me the figures always seem impossibly high for the time period, and I'm not just talking about bounties (which could be intentionally comically high) but the cost of whiskey or other sundries. They're always talking in dollars but even as recently as the 1950s and maybe more recently a single dollar was quite a bit of cash for daily purchases, let alone in the 1880s.

My question is, was the value of the dollar different from the early 20th century or is this just classic Hollywood not really caring about details like that?

My question is, was the value of the dollar different from the early 20th century or is this just classic Hollywood not really caring about details like that?